“Volatility” succinctly captures the forecast for the world economy in the upcoming year.

The upcoming volatility is anticipated to stem largely from geopolitics, as highlighted by chief economists surveyed for the World Economic Forum’s recent Chief Economists Outlook. However, the report indicates a nuanced scenario, hinting at potential positive changes such as decreases in inflation rates and a deceleration in interest rate hikes. Here are the main takeaways from the September 2023 edition of the Chief Economists Outlook.

Weak global economy in 2024?

The recent Chief Economists Outlook from the World Economic Forum suggests a potential weakening of the global economy in the upcoming year, as reported by 61% of the surveyed chief economists.

According to the report, there’s a prevalent anticipation of global economic decline in the next 12 months. The uncertainty factor remains significant, reminiscent of the concerns outlined in the May edition of the Chief Economists Outlook. While fears of a global recession are decreasing, attention is shifting to concerns about China’s economy, which has recently experienced deflationary trends.

Geopolitical issues, along with domestic political landscapes, are contributing to this volatility. A substantial 90% of economists predict that geopolitical tensions will spur economic instability in the forthcoming year. Additionally, 79% of respondents highlight the potential for domestic politics, particularly with the impending US electoral cycle, to fuel economic uncertainty.

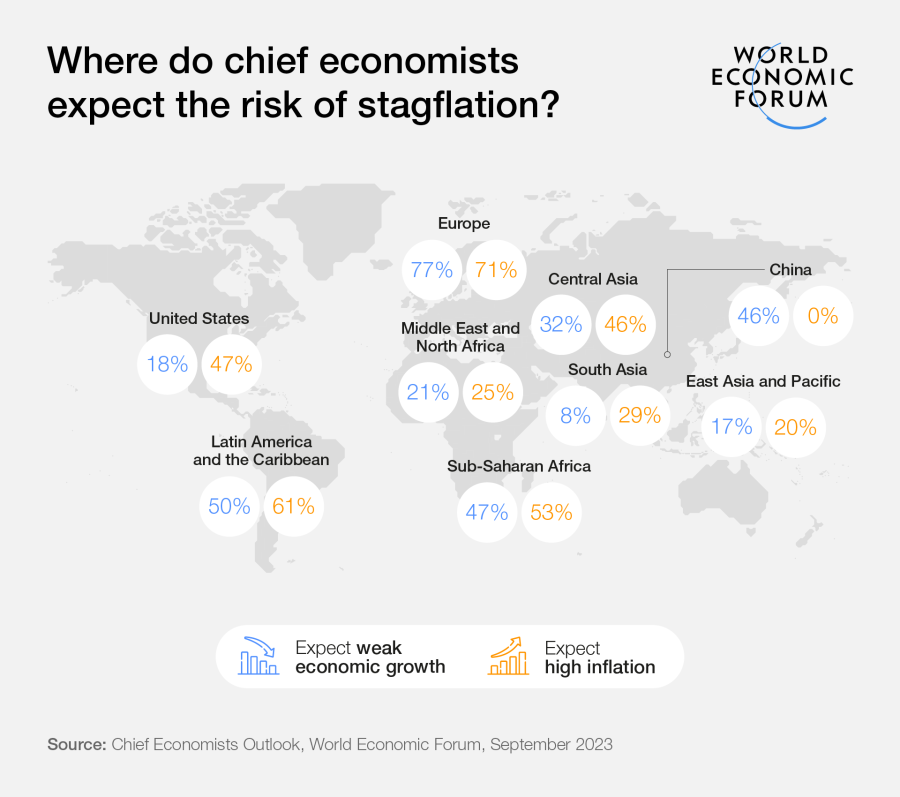

Regional economic outlooks

The latest Chief Economists Outlook highlights a widening gap in global growth prospects.

Asia, particularly South Asia, emerges as a region with robust growth potential, where 92% anticipate moderate to strong growth this year. The outlook has significantly improved, with over half projecting strong growth, a notable increase from 36% in the previous report.

However, there’s a notable decline in expectations concerning China. Only 54% foresee moderate or strong growth in the latter part of 2023, down remarkably from 97% in the previous edition. This pessimism extends into 2024.

The report attributes this shift in China’s prospects to several factors, including slower domestic consumption recovery, deflationary pressures, vulnerabilities in the real estate market, and a notable decline in trade volumes.

Contrastingly, the economic forecast for the United States has notably improved. Approximately 80% of respondents anticipate robust or moderate growth for both this year and the following, a significant rise from about 50% in the previous report.

Europe is expected to experience weak or very weak growth this year, according to 77% of respondents. However, expectations brighten for 2024, with only 41% anticipating weak growth.

In the Middle East and North Africa, 79% foresee moderate or strong growth for both 2023 and 2024, reflecting a 15-percentage-point increase from the May projections.

Inflation and interest rate pressures easing

Chief economists appear optimistic regarding the inflation outlook, with 86% expressing belief that the most severe phase of the global inflationary surge will have diminished within a year.

This perspective aligns with expectations regarding monetary policy, as 93% anticipate a deceleration in the pace of interest rate hikes within economies susceptible to inflation. Additionally, a majority—around four-fifths—of chief economists foresee a reduction in the synchronization of monetary policies among central banks.

“Nevertheless, a prevailing sense of caution remains,” the report emphasizes. “Monetary policy is likely to proceed with careful calibration in the upcoming months, given the intricate landscape of domestic and global economic circumstances, encompassing factors like climate change, evolving demographics, and intensifying geopolitical and economic divisions.”

There’s a positive shift in expectations concerning US inflation, with 54% of surveyed chief economists now foreseeing moderate or lower inflation, compared to 32% in May. However, Europe is still anticipated to confront high or very high inflation this year, as indicated by 70% of respondents.

China is encountering a distinct challenge, marked by signs of deflationary pressures evident in the results: 81% of chief economists foresee low or very low inflation this year, a notable rise from 48% in May.